Getting a home loan usually demands an extensive economic glance at, commonly associated with numerous years of tax statements to ensure consumers keeps a steady money records. Loan providers make use of these data to gauge the latest creditworthiness out-of a candidate, making sure he’s the capability to manage and pay back the loan. However, in some situations along with the correct requirements, it’s possible to rating a home loan with just one year out of tax go back.

This course of action is a boon for folks that have irregular earnings activities, freelancers, otherwise the individuals that has just educated high self-confident changes in its financial position. While you are interested in learning how-to navigate which home loan path otherwise thinking for many who be considered, continue reading. We are going to explore the fresh new insights and provide knowledge to enable the home-buying trip.

Pressures to own Mind-Operating Consumers

Toward self-working, obtaining home financing would be a complex activity compared to individuals who are conventionally working. The fresh new unstable character of some mind-employment earnings means that certain loan providers will get harbor issues about the power to care for consistent monthly installments. Additionally, the fresh new documents for mind-functioning anybody is commonly alot more thorough and certainly will feel challenging having one another individuals and you will lenders equivalent. Navigating compliment of these demands need dedication and you will an in depth speech regarding one’s financial position. Thankfully, the growing financial world has started recognizing the fresh ascending quantity of self-working professionals that’s gradually adjusting their conditions to accommodate all of them.

Yet not, as opposed to misconceptions, are self-working will not render your ineligible to own home financing. It’s a lot more about understanding the requirements and you will meeting the requirements set because of the certain lenders otherwise mortgage software. By doing so, self-working anyone discover choices that line up with their book economic things and you may keep the financial support they want.

Freddie Mac computer and Federal national mortgage association: Contrasts from inside the Mortgage Eligibility

To possess self-operating people seeking to a domestic mortgage, the typical requirements would be to render two years out-of taxation statements. Fannie Mae’s Automated Underwriting System is steadfast in maintaining this a couple of-12 months stipulation. But not, Freddie Mac’s comparable method is more accommodating. In the certain affairs, permits applicants to submit only an individual season out of taxation returns. It changes underscores the latest evolving surroundings regarding home loan credit, providing in order to diverse private points.

The key to navigating this can be partnering that have a seasoned financing specialist who focuses on helping care about-operating people. Such experts is also make suggestions to lenders particularly when you covid 19 personal loan assistance request have got commendable monetary features such as large credit ratings, big income, good off money, and you can solid cost benefits. Equipped with the best systems, the journey for the homeownership into worry about-functioning becomes more quick and encouraging.

Ideas to Increase Financing Qualifications

Understanding you have the monetary power to manage your repayments try the first step. However, to improve their attract throughout the sight of lenders, imagine after the adopting the strategies:

- Amplify Your credit rating:Your credit score serves as a representation of your own monetary accuracy. A stellar rating not only grows your chances of financing recognition as well as ranks your absolutely to possess all the way down rates of interest. A credit rating is created throughout the years, and you can timely payments, lower credit usage, and you will a combination of borrowing designs might help escalate they.

- Bring a huge Downpayment: By the committing a large count upfront, your show financial balance and you will commitment to the house or property. This significant guarantee decreases the chance for lenders and can move the decision on your side. The greater amount of you purchase initially, the newest smaller you obtain, therefore exhibiting financial wisdom.

- Manage High Dollars Reserves: An impressive disaster funds serves as proof of what you can do in order to create unforeseen economic challenges. It assurances lenders you to definitely short-term dips on your income would not jeopardize the fees feature. This type of supplies play the role of a back-up, giving loan providers the count on they can weather monetary downturns.

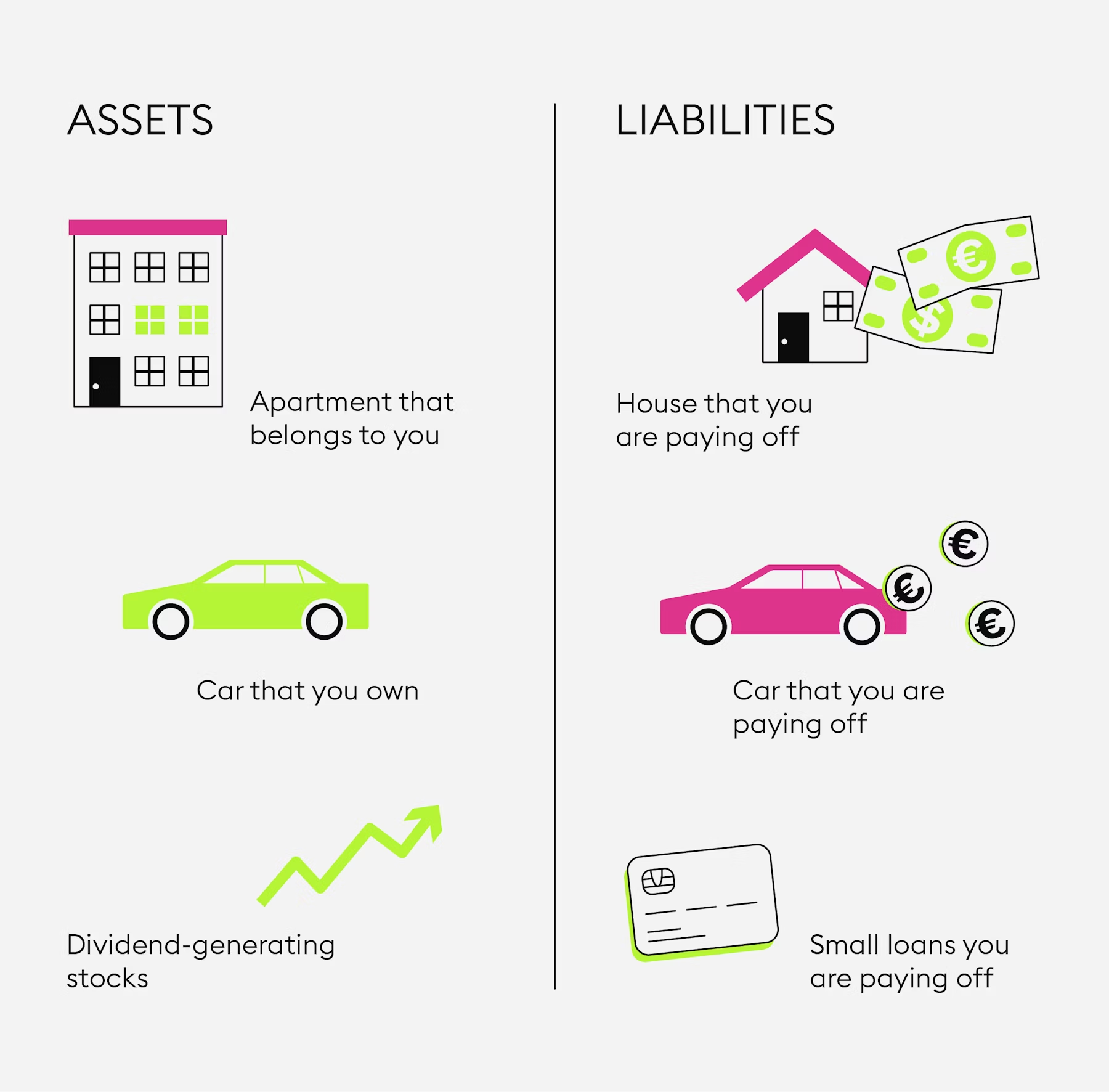

- Remove Personal debt: Less monthly obligations stands for a great deal more disposable income, in fact it is channeled towards home loan repayments. By the cleaning away from user costs, like credit cards or auto loans, you can also raise your eligible amount borrowed due to enhanced earnings. In addition, a reduced obligations-to-income ratio is definitely popular with lenders.

As to the reasons Specific Lenders Provide You to definitely-12 months Taxation Go back Mortgage loans

To your actually ever-growing freelance economy while the go up away from entrepreneurship, people was choosing non-antique profession pathways that frequently have fluctuating income channels. Taking this change, specific loan providers are receiving so much more accommodating through providing home loan software one to require only one 12 months off tax statements.

Independency to possess Progressive A position Systems:

The conventional a few-seasons tax go back specifications has its own origins into the a period when steady, long-title employment try the norm. Now, however, the sort off performs and you will income sources has changed significantly. Certain gurus possess released a start-right up or transitioned to help you a effective type of performs, resulting in a significant earnings hike regarding the current seasons. For these individuals, the very last year’s income tax go back was an even more right image from their current financial climate than simply typically couple of years.

Evaluating Other Monetary Symptoms:

While just one year’s tax go back you are going to promote a snapshot from present earnings, lenders often determine other monetary signs to guage the stability and possible lifetime of one income. This can include exploring the borrower’s works record, the healthiness of its world otherwise providers, while the trajectory of its earnings. In the event that these points mean that brand new recent earnings surge try green, loan providers is generally more inclined to help you agree home financing based on one year’s tax return.

Controlling Exposure and you will Opportunity:

Lenders come in the business out of dealing with chance, and they usually juggle the possibility of standard resistant to the options to make interest. By offering mortgages centered on just one year’s income tax go back, they could appeal to a bigger set of clients, especially those with promising economic candidates. Yet not, such loans you’ll feature somewhat highest rates of interest otherwise wanted most other compensating points, instance a much bigger advance payment, in order to offset dangers.

Navigating Homeownership with Mares Mortgage loans

Getting home financing, especially when depending on an individual year’s income tax come back, can seem challenging for many prospective property owners. But really, on correct recommendations, customized possibilities, and you will some economic strategizing, it will become an achievable dream. The loan landscape is consistently evolving, and facts its the inner workings can notably simplify the trail so you can homeownership.

For these provided which station, Mares Mortgage loans really stands since a great beacon of experience and service. Their seasoned masters was expert at the at the rear of individuals compliment of book monetary affairs, guaranteeing you may have all of the possibility to realize your dream household. Try not to navigate the complexities of your own financial business by yourself; learn how Mares Mortgage loans can also be light the homeownership excursion.