An important distinction to note is the difference between COGS and operating expenses (commonly referred to as OpEx). In the Zappos example, while the factory machinery is part of COGS, the electricity, factory supervisor’s salary, and rent are not. While these costs are incurred to generate revenue, they are indirect costs that don’t involve the product itself. Any expense incurred that (1) is necessary to generate revenue and (2) directly impacts creating a sellable product must be included in COGS calculations.

How Can You Lower COGS?

This ensures consistency across similar transactions and simplifies the reconciliation process. And when in doubt, a seasoned accountant can be your COGS compass. Embracing accounting system for managing COGS can turn what once was a daunting task into a breeze. Tools like QuickBooks Online (QBO) amplify the accuracy and efficiency of your financial dealings.

Navigating Tricky COGS Scenarios

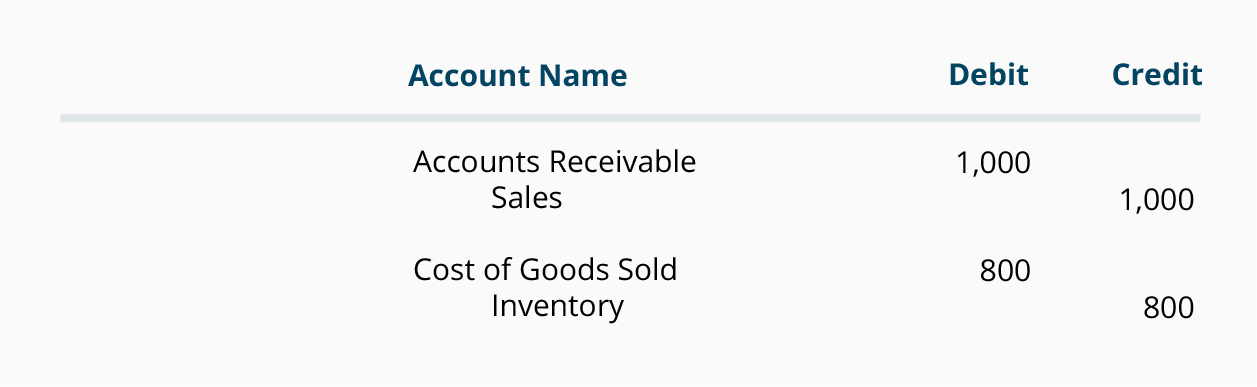

When a business purchases inventory, You make a debit to the inventory account and a credit to the accounts payable or cash account. When you sell inventory, you note a debit to the COGS account and a credit to the inventory account. Create a journal entry When adding a COGS journal entry, you will debit your COGS Expense account and credit your Purchases and Inventory accounts. Purchases are decreased by credits and inventory is increased by credits. You will credit your Purchases account to record the amount spent on the materials.

Stay up to date on the latest accounting tips and training

Knowing current costs allows for better price setting on goods or services offered, which promotes competitive pricing strategies without sacrificing margins. Consider a company that starts the accounting period with a beginning inventory value of $45,000. During the period, the company spends an additional $10,000 on new inventory, and it ends the period with an ending inventory value of $35,000. Below, we briefly review what COGS is and how you should be recording it in a COGS journal entry. We also walk through a number of COGS journal entry examples and answer other common questions about how you should be recording cost of goods sold for your business. This method gives you the COGS for the period, reflecting the direct costs of goods that were sold.

Using Accounting Software to Streamline the Process

This ensures that only the cost of the goods that were sold is reported as an expense. The journal entry ensures that the Cost of Goods Sold is accurately reported in the financial statements. Some service companies may record the cost of goods sold as related to their services. But other service companies—sometimes known as pure service companies—willn’t record COGS at all.

- Bookkeepers must track each sale with up-to-date costs to keep these numbers trustworthy.

- COGS appears in the same place, but net income is computed differently.

- These costs can include materials as well as the staff required to assemble the materials into finished sellable goods.

- COGS is a major business expense, and errors in this area can really throw your numbers off.

- To figure out the cost of goods sold, start with your beginning inventory.

We’re getting better rates from our vendors so what if we promote the newer arrivals first so that we can sell the products with the lower cost first (assuming a FIFO inventory method)? Let’s chat with marketing regarding new campaigns and with supply chain to ensure we can handle the added shipping volume without excessive delays in light of the pandemic. In accordance with the matching principle and accrual basis of accounting, COGS should be recorded in the same period as the revenue it generated.

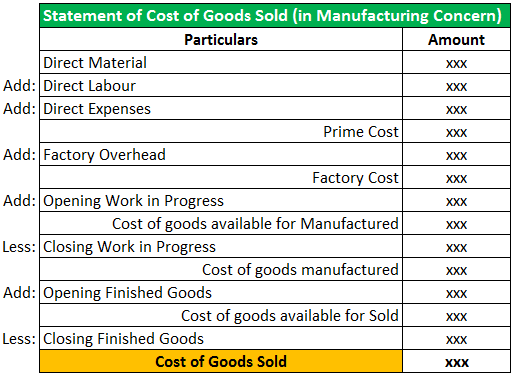

It is a measure of the cost of the product or services that are sold during a given period. Furthermore, other factors such as the recording method used and changes in the prices of materials and labor costs involved in production and sales can also affect the cost of goods sold. Understanding the factors that influence the cost of goods sold is essential for businesses how to record cost of goods sold journal entry to make informed decisions about their pricing and overall profitability. The most common factors that affect the cost of goods sold include the prices of raw materials, maintenance costs, transportation costs, and the regularity of sales and business operations. Let’s say the same jeweller makes 10 gold rings in a month and estimates the cost of goods sold using LIFO.

The following Cost of Goods Sold journal entries outline the most common COGS. Inventory is the cost of goods we have purchased for resale; once this inventory is sold, it becomes the cost of goods sold, and the Cost of goods sold is an Expense. Inventory is goods ready for sale and shown as Assets on the Balance Sheet.

The cost of goods sold (COGS) refers to the cost of producing an item or service sold by a company. COGS can equally refer to a service as well as a physical product hence the uses of the more general term Cost of sales. This formula shows the cost of products produced and sold over the year.

Using LIFO, the jeweler would list COGS as $150, regardless of the price at the beginning of production. Using this method, the jeweler would report deflated net income costs and a lower ending balance in the inventory. The nature of the cost of goods sold is an expense and is recorded in the income statement of the company during the period goods are sold.