Since a medical professional, you invested a lot of time in your knowledge and studies. That it commitment have a tendency to has tall monetary sacrifices, such as student loan personal debt. When you find yourself your peers was basically doing work, preserving, and you may accumulating riches, your appeal could have been on your own studies and you will knowledge. With our installing pressures, the notion of to get a home appears like a faraway chance, particularly when you see the standard home loan requirements. But not, there clearly was a unique monetary services only designed for some one as you scientific citizen mortgage loans.

What are Scientific Citizen Mortgage loans?

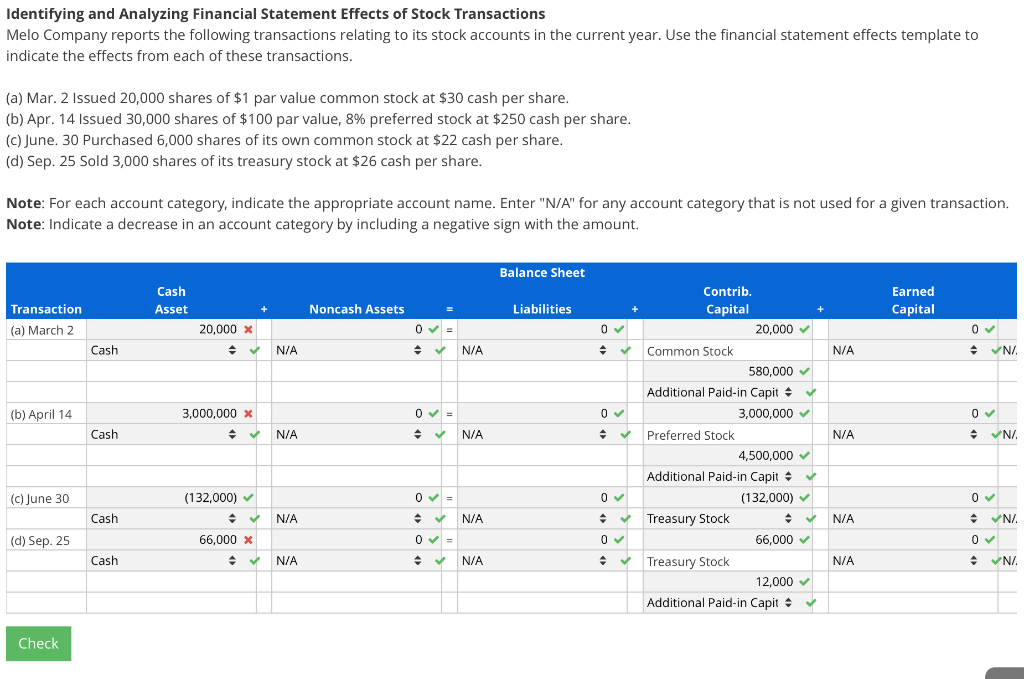

Medical citizen mortgages was a unique style of financial unit customized into particular financial factors out-of physicians, particularly those in early levels of the professions. This type of financing are designed to complement physicians which, despite having a premier loans-to-money ratio, are required to own a leading income afterwards. Let us plunge for the and you can talk about the method this type of fund performs, their masters, and you will possible disadvantages.

Novel Pressures for Physicians

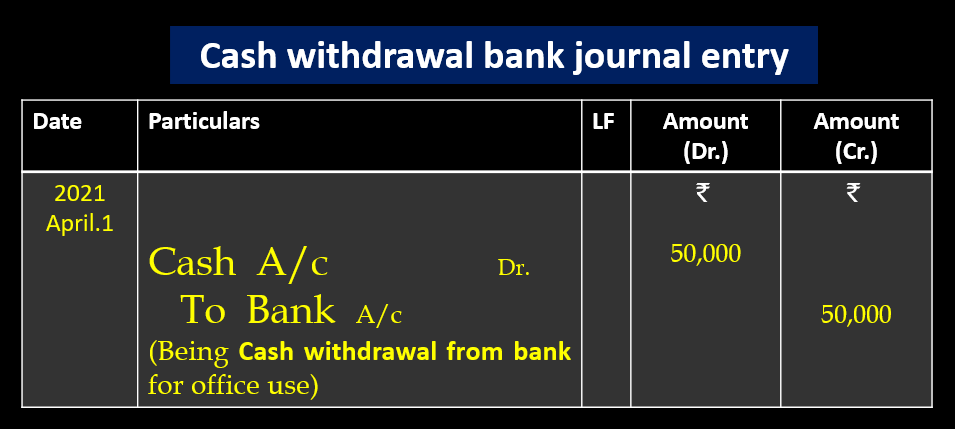

Instructional Loans: Really physicians face a leading debt obligations.