It makes it a lot easier for them to get their money sent to their bank account every day directly from PayPal without having to remember to transfer funds. For a screen by screen example of how to change these settings, make sure to check out my video tutorial linked here. Luckily, accounting software integrations and automation of accounting processes can help simplify these tasks, freeing up time for other priorities. Read on as we go beyond accounting basics and explore innovative strategies to level up your financial management.

How PayPal credit card processing can help customers make secure payments

- With this integration, you can easily track and reconcile PayPal transactions, view consolidated financial reports, and gain insights into your business’s cash flow.

- Credit cards can be processed using point-of-sale systems, online payment gateways, recurring billing methods, virtual terminals, contactless payments, ACH payments, or other methods.

- In today’s digital age, managing financial transactions efficiently is essential for businesses of all sizes.

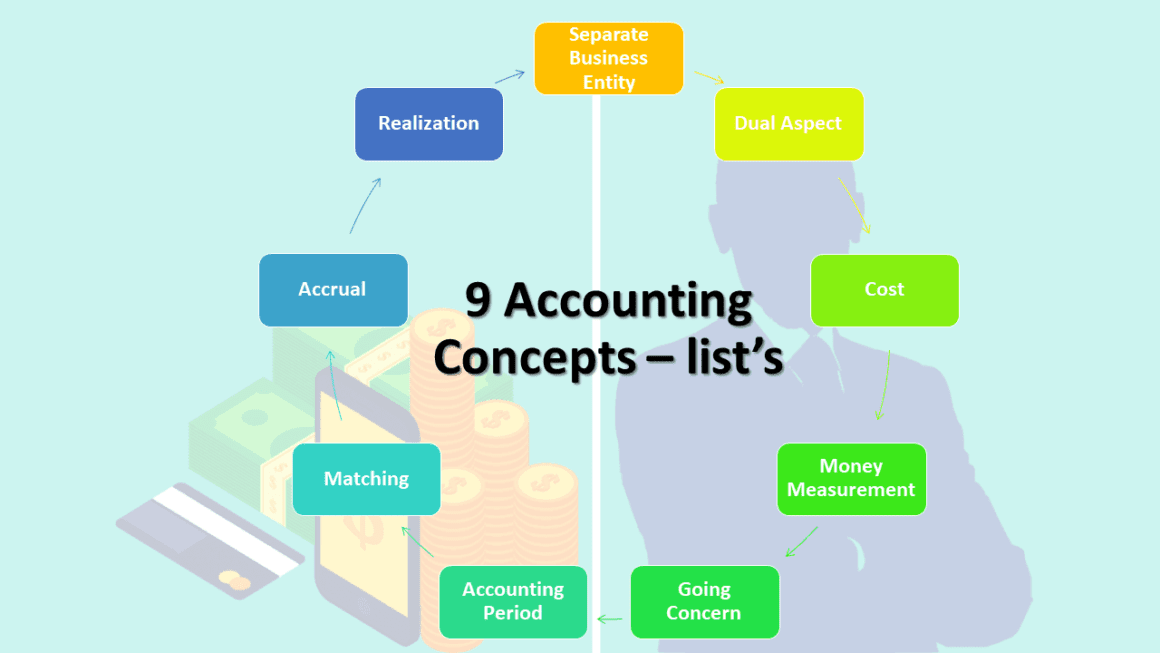

- It’s important for small business owners to understand accounting basics so they can manage their finances effectively.

- All you need to do is add your PayPal feed in the same way you would connect a new bank account.

The user-friendly dashboard features allow for real-time monitoring and analysis of PayPal transactions, empowering businesses to make informed decisions and optimize their accounting for paypal transactions financial strategies. After all, PayPal keeps a balance much like a bank account does, and transactions flow back and forth between PayPal and other bank accounts as well. You can make payments to vendors through PayPal using a linked bank or credit card account, or by using the PayPal balance.

PayPal in accounting: Correct posting of payments

Manual bookkeeping leaves you wide open to making the kind of errors that, whilst not the end of the world, could have a negative impact on your accounts – and your stress levels. Accounting software integrations refer to technologies that connect various applications to allow seamless communication and data exchange between them. The PayPal payment option can be embedded on the website as a button or in the retailer’s online shop. Here, we’ll cover the foundational concepts and strategies of small business accounting. The takeaway here is to make sure that you match and you don’t add, because if you add it, you will be duplicating the transaction. Again if the date is not the same or doesn’t agree then you’ll have to change that for it to match.

How to treat your PayPal account in QuickBooks

Failing to meet these expectations can lead to dissatisfaction and lost business. From https://www.bookstime.com/ streamlining invoicing processes to maximizing the benefits of your POS system, read on as we explore ways to reduce errors and save time. Seamlessly connect all your platforms into one ecosystem and make them communicate with each other, avoiding any duplications.

How does PayPal process credit card payments?

Regularly reconciling your PayPal transactions in QuickBooks ensures that your financial data remains accurate and up-to-date, enabling informed financial planning and decision-making. Reconciling discrepancies between QuickBooks records and PayPal statements involves identifying and resolving any inconsistencies to ensure the accuracy of your financial data. This reconciliation also helps in identifying any discrepancies or errors, allowing for timely correction and ensuring that your financial statements in QuickBooks truly reflect the state of your business. Integrating PayPal fees into QuickBooks allows for better insight into the true costs of accepting payments through PayPal, ultimately leading to more informed cost management strategies. The integration also simplifies tax preparation by ensuring that all financial records are up-to-date and accurate. Creating a PayPal account in QuickBooks is a fundamental step towards streamlining your online sales and transactions with your QuickBooks accounting system.

This blog article has been written to assist the readers of our blog in resolving this conundrum. The answer is relatively simple and you’ll be relieved to hear that it doesn’t involve hours of extra work and extensive additional bookkeeping duties. When a customer pays for their purchases, we process the payment bookkeeping and transfer the funds to your PayPal account. When you accept credit card payments with PayPal, you unlock the ability to reach more customers and grow your revenue. You will find out right away that trying to download PayPal statements is very time consuming so it is something I do not like doing more than once per statement period.

For the online payment service, PayPal charges a commission that the retailer has to pay. Paper records are at serious risk of loss or damage, even if you duplicate them. Digital records are readily available via the cloud, leaving you safe in the knowledge that your data is secure and easy to access.

- When a customer places an order, the system automatically generates and sends an invoice, updates inventory levels, and records the sale in the financial ledger, with no manual intervention needed.

- Implementing effective strategies for recording PayPal transactions in QuickBooks can streamline your financial management and provide valuable insights into your online sales.

- Accounting tools may also come with additional features that you can use to better track your finances and grow your business.

- Failing to meet these expectations can lead to dissatisfaction and lost business.

- For the online payment service, PayPal charges a commission that the retailer has to pay.

More often than not, the easy option won’t be the one that helps you grow, evolve and develop your operations. It’s taking things to the next level – no matter how scary it might seem – that will get you where you want to go. This capability can be invaluable for businesses operating in multiple locations, such as vendors at festivals or pop-up shops. Start today and enjoy your free trial with no commitment or credit card required.