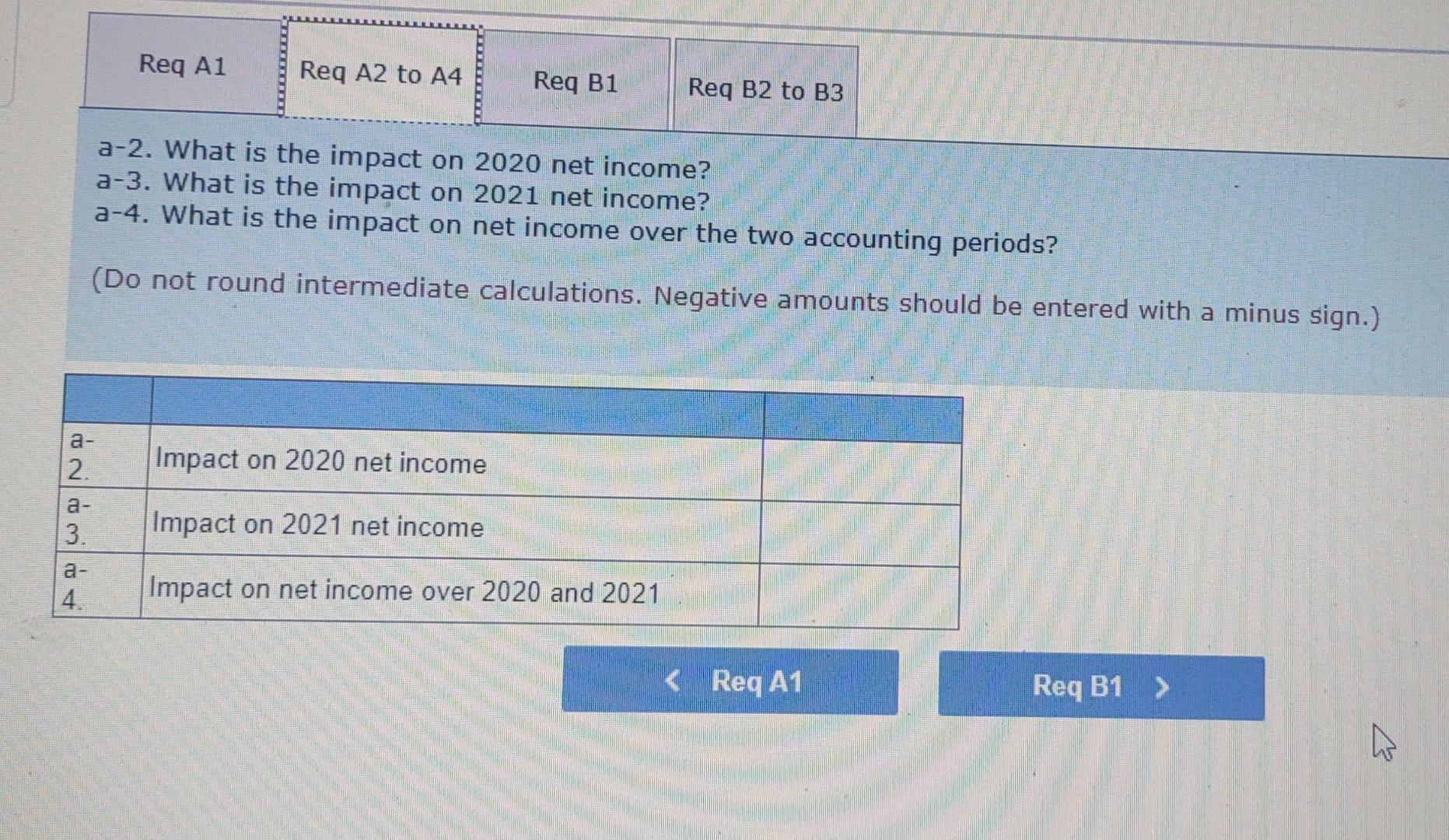

Precisely what does They Suggest to own Negative Equity in your home?

Domestic guarantee is how a great deal more you reside value than simply your balance inside. Bad collateral, also referred to as being under water otherwise upside-down, mode you borrowed from on your own real estate loan compared to domestic will probably be worth. The worth of a property transform according to things like have and you may interest in a home additionally the wellness of your cost savings.

However visitors wishes equity in their house. When you have sufficient, you have the accessibility to offering your property to have a revenue. Bad equity is crappy and most property owners never ever forecast having they.

When anyone buy a property they predict the worth of its home to go up gradually. Their simply issue is exactly how much as well as how easily it will do so. For most people, concerns are much more after they be home owners.

Determining Your own Equity

You really know precisely just how much your debt on the financial loan since you get a statement in the lender per month. However the market value of your house isn’t really a primary matter unless you are selling they or it gets expensive. In the event that’s your, otherwise you may be simply interested, you could take a look, set up your address, and also have a no cost imagine of the house’s worthy of.

The above hook up is not a proper appraisal, nevertheless can present you with a standard thought of the place you remain. If your guess states your home is well worth $150,000 below the fresh outstanding harmony on the loan, that could be a sign you to definitely possessions values near you features decrease pretty rather.

Read morePrecisely what does They Suggest to own Negative Equity in your home?