On May 21, we paid with cash so we do not have credit terms since it has been paid. The term “inventory” can refer to the physical goods on hand in the store or it can refer to the Merchandise Inventory flight crew cell phone and data plan tax deduction rules account, which is the financial representation of the physical goods on hand. The accounting records should, at any point in time, accurately reflect the cost of the physical goods on hand.

Get in Touch With a Financial Advisor

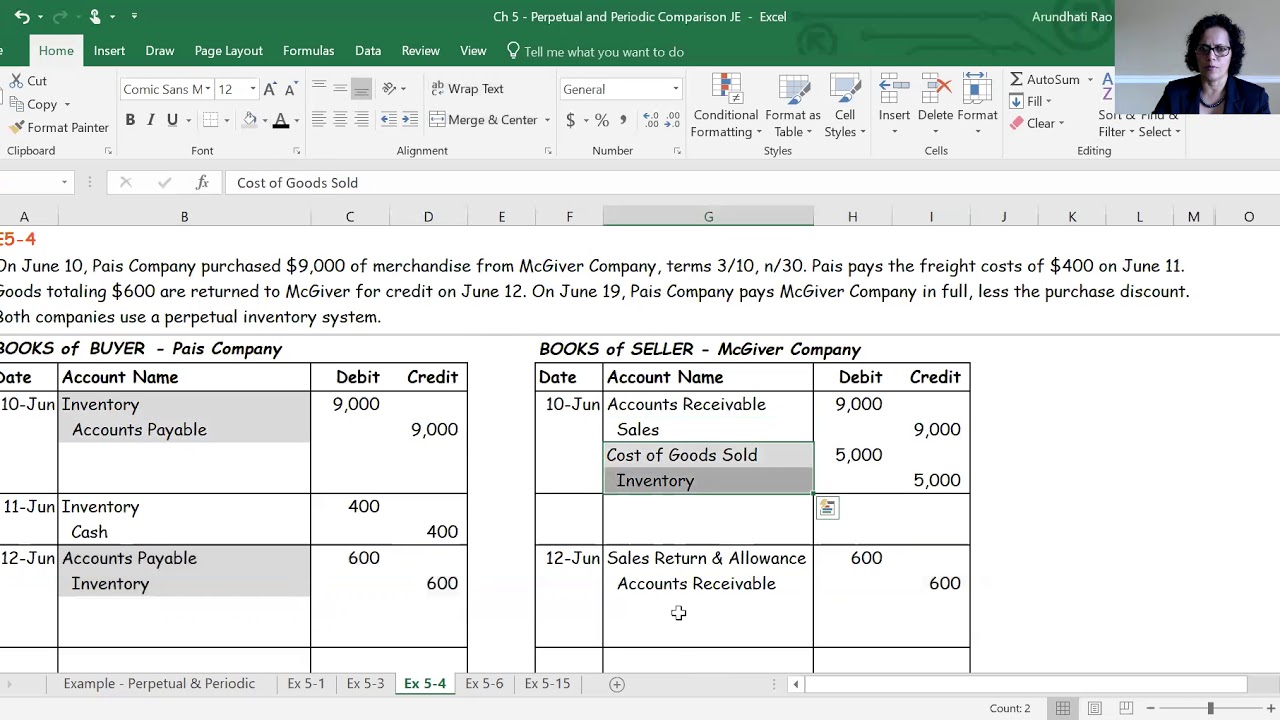

Under the periodic inventory system, when company makes sales, they only record the revenue and accounts receivable/cash. The journal entry is debiting accounts receivable or cash and credit sales revenue. In a periodic inventory system, you update the inventory balance once a period. You can assume that both the sales and the purchases are on credit and that you are using the gross profit to record discounts. The periodic inventory system refers to conducting a physical inventory count of goods/products on a scheduled basis. Maintaining physical inventories can be costly because the process eats up time and manpower.

How Do You Calculate Cost of Goods Sold Using the Periodic Inventory System?

Under the LIFO Method, cost of goods sold is calculated using the most recent inventory first and then working our way backwards until the sales order has been filled. Because the physical accounting for all goods and products in stock is so time-consuming, most companies conduct them intermittently, which often means once a year, or maybe up to three or four times per year. A beauty salon or barber shop, for example, where services are rendered but a small amount of inventory is kept on hand for occasional sales, would certainly not need to absorb the cost of a perpetual system. Visual inspection can alert the employees as to the quantity of inventory on hand. Using the purchase transaction from May 4 and no returns, Hanlon pays the amount owed on May 10. Instead, we periodically count the ending supplies “inventory,” and then we back into the cost of supplies used.

Everything to Run Your Business

COGS for the first quarter of the year is $350,000 ($500,000 beginning + $250,000 purchases – $400,000 ending). Note that this adjusting entry adjusts the merchandise inventory account to its proper ending balance in order to zero out the purchases account and create a cost of goods sold account. The transaction will record inventory based on the month-end physical count.

Shipping on Inventory Purchases

FIFO means first-in, first-out and refers to the value that businesses assign to stock when the first items they put into inventory are the first ones sold. Products in the ending inventory are the ones the company purchased most recently and at the most recent price. In a periodic FIFO inventory system, companies apply FIFO by starting with a physical inventory. In this example, let’s say the physical inventory counted 590 units of their product at the end of the period, or Jan. 31. Below are the journal entries that Rider Inc. (the sporting goods company) makes for its purchase of a bicycle to sell (Model XY-7) if a perpetual inventory system is utilized.

Periodic FIFO

- One other key difference between the two systems is the accounts you use.

- COGS for the first quarter of the year is $350,000 ($500,000 beginning + $250,000 purchases – $400,000 ending).

- That’s why a periodic inventory system is only mainly used by small businesses with limited inventory and few financial transactions.

- The periodic inventory system is a software system that supports taking a periodic count of stock.

- These companies often don’t need accounting software to do the counts, which means inventory is counted by hand.

- The term “inventory” can refer to the physical goods on hand in the store or it can refer to the Merchandise Inventory account, which is the financial representation of the physical goods on hand.

If there are purchase returns and purchase discounts, the company has to reduce the purchase account. The journal entry is debiting accounts payable and credit purchase accounts. Perpetual inventory systems are designed to maintain updated figures for inventory as a whole as well as for individual items.

Also assume that where discounts are provided or availed on sales/purchases, they are recorded using the gross method (to learn more about gross method, see discount on sales and discount on inventory purchases). Sales Return and Sales Discount is the contra account of sales revenue, so it simply reduces the sale amount from income statement. So during the month, we do not know about the inventory balance and cost of goods sold at all.

Let’s say our product manager, Cristina, wants to know if she is pricing her company’s generic Bismuth subsalicylate high enough to leave a healthy profit margin. If she calculates the COGS as $10 per 100-mL bottle, she will need to price each bottle higher than $10 so her company can comfortably turn a profit. Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI’s full course catalog and accredited Certification Programs. Examples of these types of businesses include art galleries, car dealerships, small cafes, restaurants, and so on. A merchandising business buys product from vendors, marks it up, and sells it to customers. Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.