Va finance

A Virtual assistant mortgage is actually for energetic-service army participants or experts, or certain qualifying spouses off professionals with passed away. Va americash loans Stockton loans always charges down home loan interest rates than antique mortgages.

- Deposit: Nothing

- Credit rating: For each and every lender kits its standards, however, many need at the very least an excellent 660 score

- DTI: 41% is the Virtual assistant tip, however it can vary

USDA funds

- Downpayment: Not one

- Credit score: Zero set lowest about Agencies regarding Farming, however, many loan providers require 640

- DTI: 41%

Masters regulators-supported mortgage loans

There are many different benefits and drawbacks from regulators-recognized mortgage loans, however, one of the largest is they are convenient to help you be eligible for than other type of mortgages. Listed below are are just some of the benefits you’ll generally speaking delight in with a federal government-recognized home loan.

Reduce costs

Picking out a large advance payment try challenging for some homebuyers, but with bodies fund, that isn’t so much from a challenge.

Va and you will USDA loans do not require one down-payment ( you can offer one to if you have the dollars), and you may FHA loans ask for merely step three.5% down. (Should your credit history try less than 580, in the event, you will want no less than ten%).

Antique fund require at least 3% up front otherwise, usually, 20% if you wish to prevent paying for home loan insurance coverage.

Flexible borrowing from the bank conditions

In ways, it’s more straightforward to be eligible for a national mortgage compared to a traditional mortgage. Of numerous lenders offers an FHA loan having a diminished credit rating than just for people who removed a conventional home loan, and you may make an application for most of the about three particular authorities-supported mortgages which have increased DTI compared to a conventional loan.

Virtual assistant and you may USDA funds do not have official credit history minimums place of the government (in the event personal loan providers is also lay their own thresholds.)

Potential for lower interest levels

FHA, Virtual assistant, and you may USDA mortgage loans generally fees down interest levels than simply conventional mortgage loans. According to Frost Mortgage Tech, the average speed on old-fashioned loans at the beginning of try 7.36%. Va financing had mediocre cost of simply 6.66%, when you find yourself FHA loan prices averaged 6.77%.

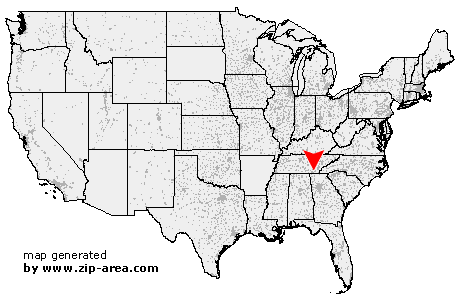

Government-backed mortgage standards are different to own FHA vs. Va compared to. USDA money. FHA funds require no less than a 400 credit score and you may a good step 3.5 to help you ten% advance payment. Virtual assistant funds are merely for army participants and you may veterans, but have zero credit history or down payment criteria. USDA loans is for selecting property during the recognized rural parts. There is also no set-in-stone credit score otherwise down-payment standards.

FHA loans need financial insurance policies which you can fork out front and you will monthly. USDA finance has actually an excellent “make certain payment,” and this is paid up side and you will monthly, while Va fund need a-one-date funding payment within closure. This type of work similarly to home loan insurance coverage, coating a few of the government’s charges for guaranteeing the loan.

Possibly, the closing costs into government financing was more than those people into antique financing due to extra costs and you can financial insurance premiums. These could become offset by lower rates, whether or not.

Of several loan providers give authorities-supported mortgages, as well as biggest banking institutions an internet-based loan providers. Discuss with, and make certain to choose one to which have experience with the mortgage system you’re interested in. It is possible to find assistance from a mortgage broker, who’ll section you into the authorities-recognized mortgage brokers that assist you buy a knowledgeable mortgage terms and conditions you’ll.

Bodies mortgages is going to be wise options for earliest-time homeowners, borrowers which have reduced-than-prime credit, and you may customers with small down money, as they become more straightforward to qualify for than simply conventional financing.