Whenever you are most popular for its low-down percentage solution, there is certainly much more to know on the FHA money in relation to them. This article commonly walk you through the basics of FHA finance by reacting the key issues new homebuyers features regarding the the merchandise.

Into the 2018, almost 17% of all mortgage brokers had been supported by this new FHA as well as the bulk of them finance-83%-visited first-time homebuyers. Inspite of the interest in FHA loans, of many homebuyers do not understand the way they work.

What exactly is an enthusiastic FHA loan?

The new Federal Property Administration (FHA) ‘s the largest mortgage insurance provider all over the world possesses insured more 46 billion mortgage loans as the their founding in the 1934. The FHA will not financing funds. Instead, it ensures mortgage loans produced by FHA-approved loan providers.

Just how can FHA fund works?

FHA funds are included in a team of fund which might be backed by the us government. personal loans in Columbus MT with bad credit This means that rather than in reality lending money, the brand new FHA even offers a guarantee to help you finance companies and private loan providers you to definitely they safeguards loss it incur if the brand new borrower cannot repay the borrowed funds completely.

Due to this reduced risk, loan providers have the ability to promote financing which have lower down payments to help you consumers who’s got poor credit otherwise tight budget. Since FHA helps make mortgage loans so much more open to borrowers which have limited income and you may borrowing from the bank, there’s absolutely no income restrict with the FHA money and you will anyone just who matches minimal being qualified standards can enjoy the huge benefits.

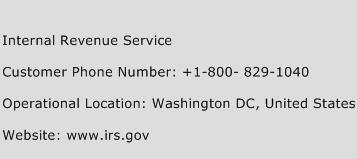

Due to the popularity of the application form of many lenders are acknowledged to provide FHA money. To greatly help determine whether the financial institution you’ve selected try FHA-recognized you might go into their details about the Department out of Houses and you can Metropolitan Development’s (HUD) bank lookup unit.

Who you certainly will an enthusiastic FHA loan getting right for?

When you are FHA loans are around for many different types of borrowers, they can be such better-suited to earliest-big date homeowners and buyers whom propose to live-in our home full-day.

The minimum down-payment requirement of merely step three.5% (that have at least credit rating out of 580) to have an FHA loan renders homeownership a lot more attainable of these which have nothing savings. First-day homeowners gain benefit from the system simply because they lack security away from a previous home revenue to place towards the its down percentage.

When you find yourself FHA funds try attractive to basic-day homebuyers hence, there’s no requisite that you must be buying your basic family so you’re able to meet the requirements.

As the FHA financing are included in an excellent federally funded program to help you prompt homeownership, they may not be open to dealers otherwise individuals purchasing another domestic as well as their number 1 household. People domestic which is bought that have an FHA mortgage must usually function as the borrower’s number one home.

What is the difference between an FHA and a normal loan?

Old-fashioned funds was mortgage loans that are not backed by a national be sure. He’s normally considered to be more challenging to qualify for but bring borrowers better independency.

One to significant difference between FHA and you can antique or practical home loans is that the all the way down upfront price of a keen FHA mortgage commonly implies that it is more pricey throughout the years. A diminished downpayment mode a much bigger show of the property pricing is financed so the buyer will pay a lot more focus along the lifetime of the loan. A higher advance payment together with commonly contributes to investing reduced having home loan insurance coverage. Loan providers will generally speaking waive the borrowed funds insurance policies commission altogether if the borrower leaves 20% or even more down.

* For just one-tool characteristics. Real financing limit depends on the latest county. Highest limitation needs an excellent jumbo loan at the additional expense ** For one-tool features, with respect to the state Supply: U.S. Development and you can Industry Report; Investopedia; Federal national mortgage association; The loan Records; Federal Construction Funds Service (FHFA); Company out of Housing and you may Urban Development (HUD)