It also helps in audit facilitation by providing the data needed by auditors. Both parties agree to a price that the purchaser pays in consideration of goods or services. This purchase price is the transaction amount for all purchase journals.

Purchase journal Entries:

- Postings from the purchases journal follow the same pattern as postings from the sales journal.

- The Times was founded as the conservative New-York Daily Times in 1851, and came to national recognition in the 1870s with its aggressive coverage of corrupt politician William M. Tweed.

- So, when any person or department needs any goods, they have to send a request to the Purchase department; if the goods are already available in the stock or warehouse, the purchasing department will issue the goods.

- This entry would then be posted to the accounts payable and merchandise inventory accounts both for $2,500.

- When this happens, it is important to note the individual amounts of each product or service along with the invoice number for accurate tracking.

When the kitchen manager places an order for $100 of inventory with a vendor, Buckley typically has 30 days to pay for the order. This credit transaction would be recorded by debiting inventory and crediting accounts payable for $100. Each accounting team develops its own reporting periods for aggregation. You may balance retirement income accounting journals weekly, biweekly, or monthly, depending on your business needs. Journal aggregation means that you summarize a period of spending from a purchase journal and add it as an entry to the general journal ledger. All of the purchase on credit transactions are posted to this journal on an order-by date.

Accounting for Credit And Cash Purchase Transactions (Explained With Journal Entries)

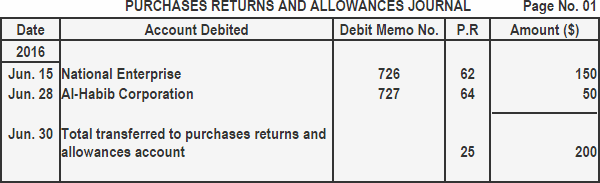

Businesses often have hundreds of purchases that range from office supplies to services. In most cases a purchase journal will not have many credits since you use it to track spending. For example, you receive a refund for returning a purchase or adjusting an expense amount. The purchases journal is mainly used to record merchandise and inventory purchases on credit. If these are the only transactions recorded in the purchases journal, then the journal is similar to the one shown in the example below. A purchases journal is a special journal used to record any merchandise purchased on account.

Related AccountingTools Courses

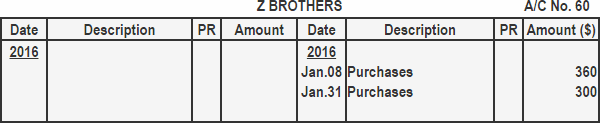

In double-entry accounting, transactions are recorded in the journal through journal entries. A typical purchases journal has several columns to record the date, vendor account, invoice date, credit terms, accounts payable balance, and other account balances. All of these columns use source documents that were acquired throughout the voucher system. The purchase order is used to record the terms of the vendor’s credit. As the business maintains control accounts in the general ledger, the accounts payable ledger itself is not part of the double entry bookkeeping, it is simply a record of the amounts owed to each supplier. These examples highlight how inventory purchases impact a company’s accounting records, affecting both the balance sheet and cash flow, depending on whether the purchase was made in cash or on credit.

Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

What is a Purchase Journal? Example, Journal Entries, and Explained

The journal entry shows that the company received computer equipment worth $1,200. However, there is a decrease in cash because we paid for the computer equipment. You will have no trouble as long as you know how to use debits and credits and what accounts to record.

The journal also includes the recordation date, the name of the supplier being paid, a source document reference, and the invoice number. Optional additions to this basic set of information are the payment due date and authorizing purchase order number. The information recorded in the purchases journal is used to make postings to the accounts payable ledger and to relevant accounts in the general ledger. The purchase journal is a book of prime entry and the entries in the journal are not part of the double entry posting. Purchase journals are special journals used by an organization to keep track of all the credit purchases.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.